Shop designer bags worldwide

Shop designer bags worldwide

All Handbags 2

Global Luxury Bag Market Revenue 2025: Industry Analysis

The Bolsino Editorial Team Updated On noviembre 02, 2025

14 lectura mínima

The Bolsino Editorial Team Updated On noviembre 02, 2025

14 lectura mínima

Key Market Findings

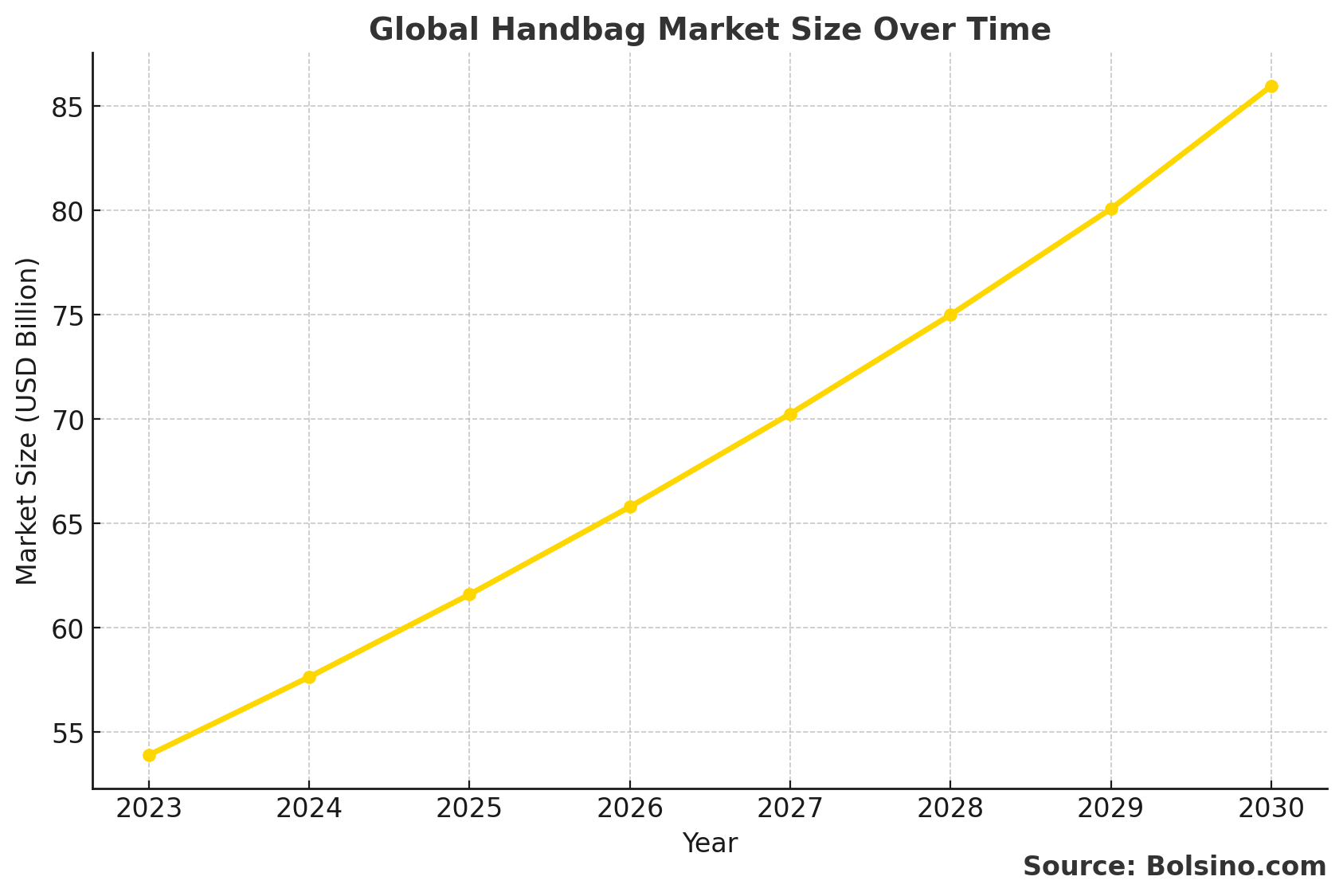

Currently, the global handbag market shows strong growth and strength in 2025. According to the latest industry research, the market is valued at about USD 59.62 billion in 2025 and is expected to reach USD 81.79 billion by 2030. For detailed quarterly insights into market performance, pricing trends, and brand movements, Bolsino's quarterly market report provides comprehensive analysis of the luxury handbag sector. In addition, this shows a steady combined annual growth rate (CAGR) of 6.5% during the forecast period.

Market Growth Highlights

The luxury handbag market, specifically, reached USD 35.83 billion in 2025 and is expected to grow to USD 60.42 billion by 2034, with a steady CAGR of 5.98%. Furthermore, industry experts predict that changing consumer likes, more money to spend, and digital change will drive continued growth throughout the next decade. As a consequence, this trend shows no sign of stopping.

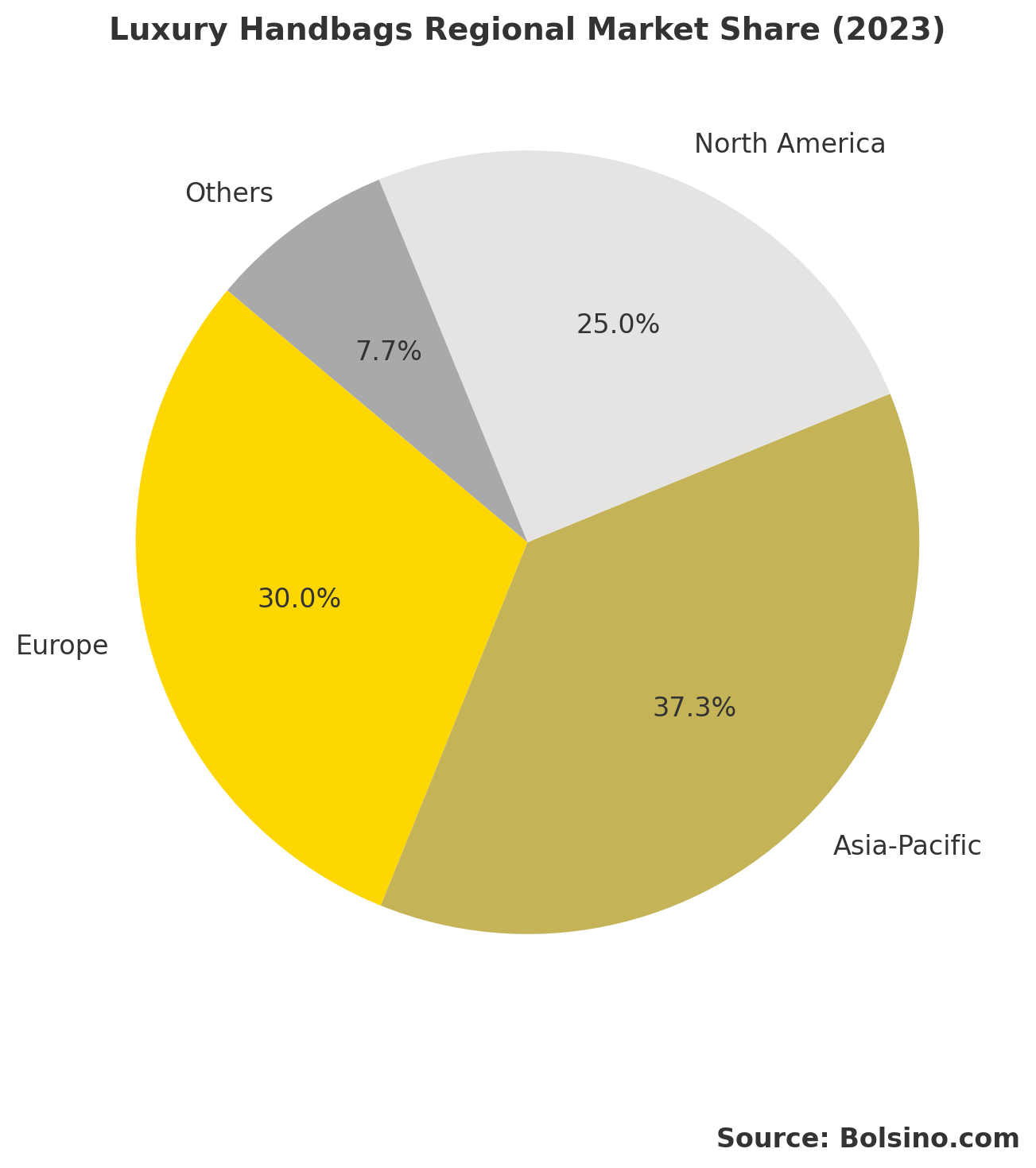

Leading Market Areas

Europe keeps its place as the main force in the luxury handbag field, holding a 36% market share in 2024. Meanwhile, Asia-Pacific is becoming the fastest-growing area, with an impressive CAGR of 7.7% projected from 2025 to 2030. As a result, brands are increasingly focusing their growth plans on these fast-growing markets. For this reason, the region has become a top target for brand expansion.

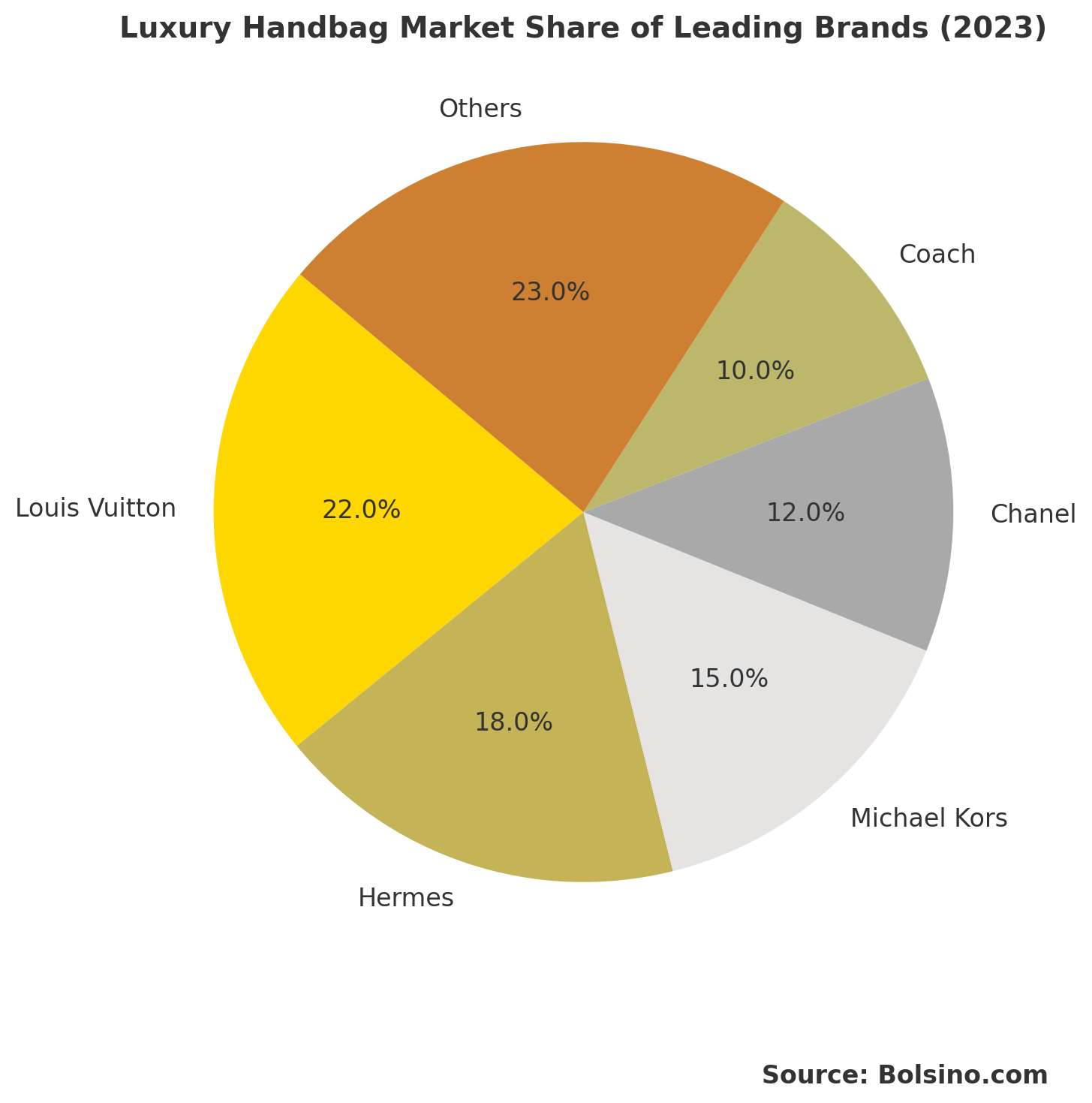

Major Industry Players

Global luxury handbag brands such as Louis Vuitton, Chanel, Gucci, Hermès, and Prada keep their place as top leaders in the luxury handbag field. Moreover, these well-known brands use their hard-earned name for excellent skill, new design ideas, and smart digital marketing to keep their lead over rivals. Indeed, their strategy continues to yield strong results year after year.

Understanding the Global Handbag Market Revenue

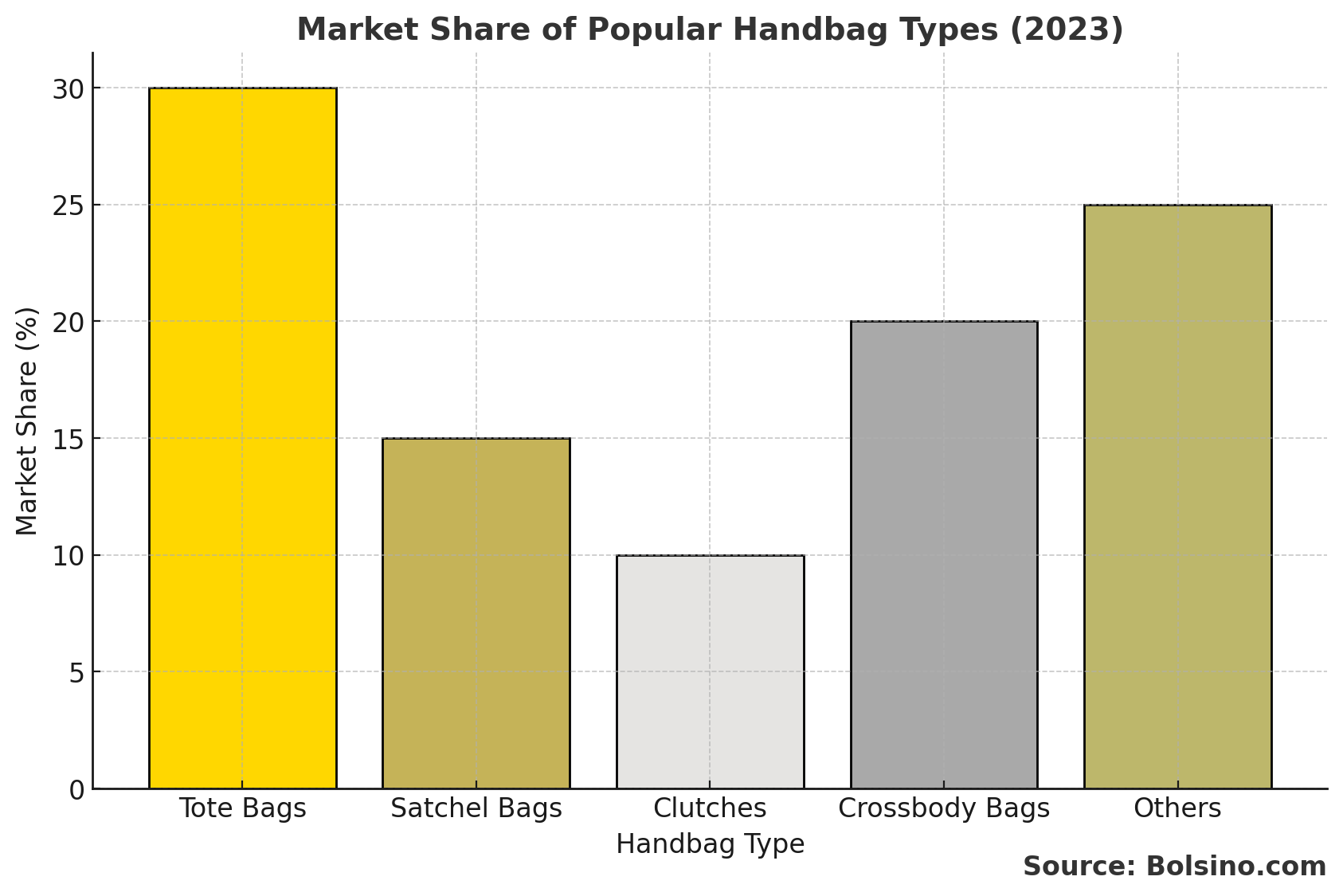

The handbag market revenue covers sales from different product types, including tote bags, clutches, satchels, crossbody bags, and backpacks across many price ranges. In addition, the market includes both luxury and standard offerings sold through retail stores and online shopping websites. Notably, both channels play important roles in overall sales.

2025 Market Value and Forecasts

At this time in 2025, the global handbag market size shows big changes across different research sources, with values ranging from USD 59.62 billion to USD 67.9 billion. However, all major market study firms agree on strong growth push driven by several key factors. Clearly, the consensus points toward continued expansion.

Growth Direction

The market saw strong growth from USD 56.48 billion in 2024 to current 2025 levels. Therefore, the industry shows no signs of slowing down, with forecasts showing the market will go over USD 100 billion by 2032-2033. This ongoing growth shows rising global demand for both designer bags and low-cost fashion add-ons. Significantly, every region is experiencing this upward trend.

Regional Market Split

Europe: The European handbag market was valued at USD 12.90 billion in 2025 and is expected to reach USD 22.05 billion by 2034, growing at a CAGR of 6.13%. Notably, countries like France, Italy, Spain, Germany, and the United Kingdom serve as key centers of luxury skill and fashion new ideas. The high money to spend per person in Germany (USD 53,815), France (USD 46,184), and Italy (USD 42,413) greatly helps strong consumer spending on high-end add-ons. Evidently, wealth in these nations supports sustained luxury demand.

Asia-Pacific: This area accounted for 37.30% of global handbag market revenue in 2022 and keeps growing fast. In particular, China, India, Japan, and Southeast Asian nations drive growth through growing middle-class groups, more jobs, and growing fashion interest among younger people. Additionally, online shopping and social selling websites have changed how buyers in this area find and buy luxury handbags. Undoubtedly, this region represents the strongest growth opportunity.

North America: The North American market is expected to grow at a CAGR of 5.4% from 2025 to 2030. Similarly, the United States, with 30.7 million small groups as of 2023, shows strong need for work and business handbag plans. Plus, seasonal sales times and digital marketing efforts greatly boost buyer interest. Accordingly, retailers are investing more resources in this market.

Middle East and Africa: While now smaller in market size compared to other areas, these markets show big growth promise. Specifically, money growth, more foreign money going in, and more people moving to cities add to growing need for luxury goods. Importantly, these emerging markets will likely become major drivers in coming years.

Driving Forces Behind Handbag Market Revenue Growth

Money Factors and Consumer Spending

Growing money to spend around the world serves as the main push for luxury handbag sales growth. Moreover, as money grows and home money goes up, buyers spend more on top fashion add-ons that show status and own style. Essentially, economic prosperity directly fuels handbag demand.

Rising disposable income globally serves as the main push for luxury handbag sales growth. Moreover, as money grows and home money goes up, buyers spend more on top fashion add-ons that show status and own style. For investors looking to diversify their portfolios, luxury handbags have emerged as a viable alternative asset class, with certain models outperforming traditional investments like gold and stocks. Essentially, economic prosperity directly fuels handbag demand.

Jobs and Workforce Trends

The growing part of women in jobs directly helps handbag market growth. For instance, the female job rate in the United Kingdom hit 72.3% from October to December 2022. As a result, work experts need useful yet smart handbags for carrying work items, files, and own things, pushing need for flexible plans. Ultimately, this shift in employment patterns creates new buyer groups.

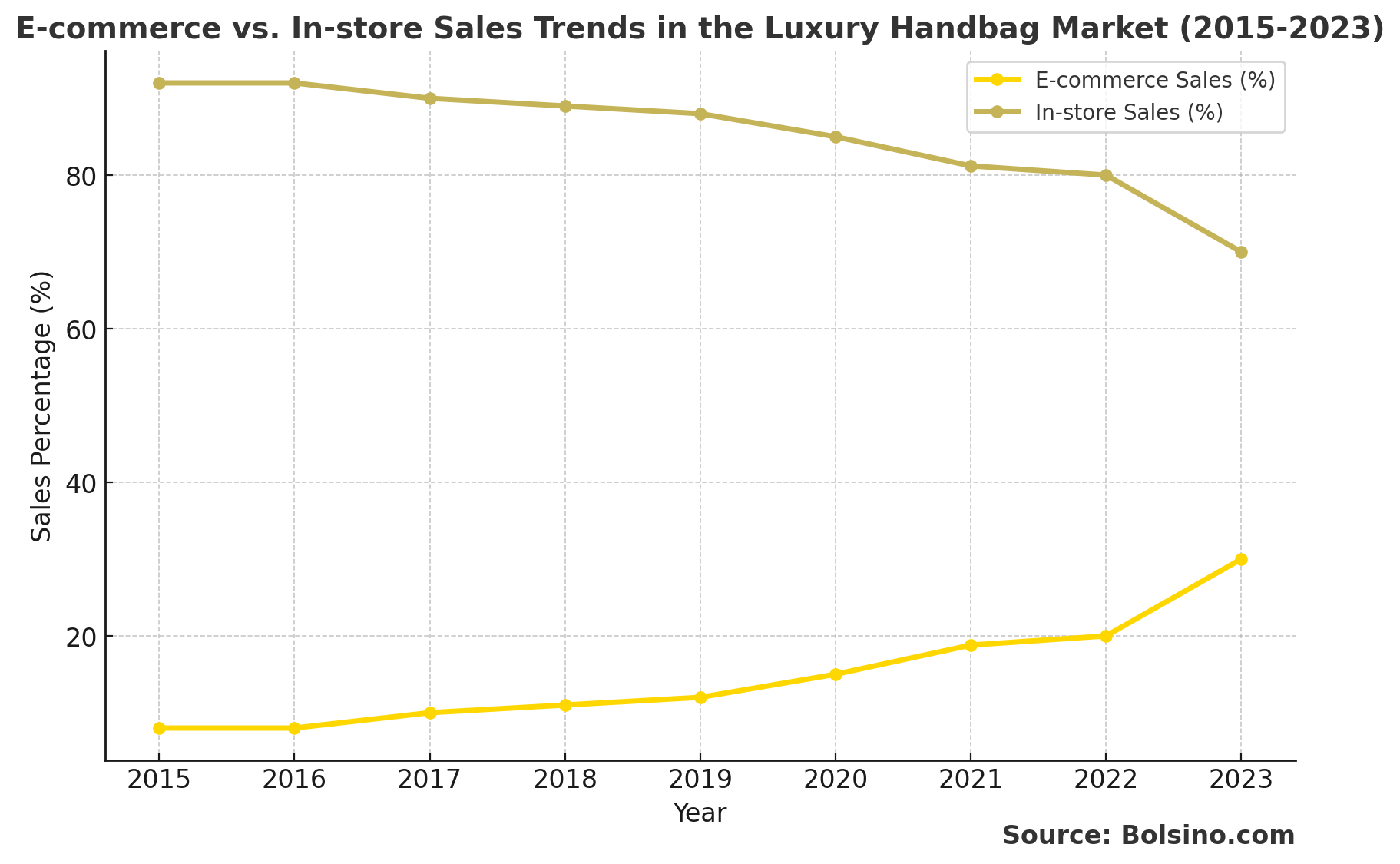

Digital Change and Online Store Growth

The rise of online retail has fully changed the fashion add-ons market. Specifically, online sites give buyers easy access to huge product picks, fair costs, and shopping made just for you. Additionally, social selling through Instagram, TikTok, and Facebook has become a big sales push, mostly among younger buyers. Consequently, traditional retail must adapt to remain competitive.

Tech Work

Luxury brands more and more put money into new tech try-ons, AI-powered made-just-for-you feel, blockchain checking, and NFC chips for item proof. Furthermore, these new tech add-ons boost buyer interest while handling worry about fake goods in the luxury field. Indeed, technology is reshaping how consumers interact with brands.

Fashion Trends and Consumer Likes

Fashion interest, mostly among young and Gen Z buyers, greatly changes designer handbag market moves. Moreover, buyers more and more look for one-of-a-kind, made-just-for-them goods that show their own way and values. Star praises, social media star ads, and online sharing make brand notice and want bigger. Evidently, social influence drives purchasing decisions in this market.

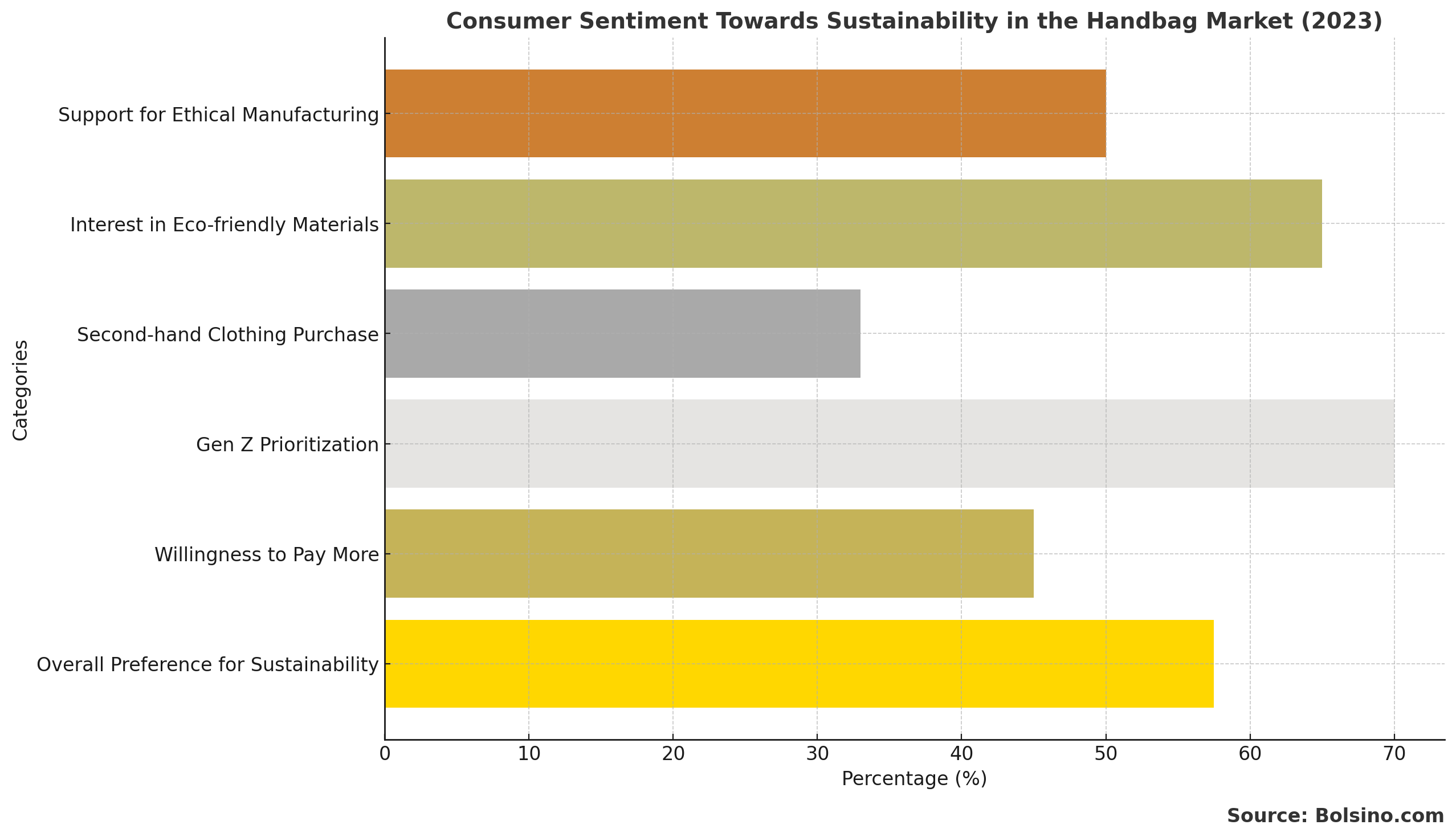

Care for Nature Movement

Worry about the world has become more and more key in buyer buying picks. Therefore, top brands are putting time into eco-safe work ways, such as:

-

Plant-based and made-in-lab leather picks

-

Used and made-new goods and stuff

-

Clear supply line where things come from

-

Round business models with buy-back and sell-again plans

-

No-carbon work goals

For instance, Gucci has made a pledge to hit no-carbon goals all through its full work line, while brands look at new mushroom leather, living-made goods, and pineapple leather (Piñatex) as safe picks to old leather. Notably, this trend is accelerating across the industry.

Product New Ideas and Design Change

New ways of making goods mark a big growth push in the luxury handbag market. Beyond safe goods, brands are making smart handbags with power chargers in them, Bluetooth links, GPS track, and RFID guard. These tech-added goods appeal to digital-smart buyers looking for both style and work use. Significantly, innovation is becoming a key differentiator.

Design Trends

Now styles favor clean looks, all-gender plans, and old-school put-away goods with strong sell-again worth. Meanwhile, tiny bags keep their favor along with old totes and satchels. Brands also give out put-together plans with goods you can take off and swap, letting buyers make their handbags fit for many times. Importantly, customization options increase customer satisfaction.

Major Players Shaping the Luxury Handbag Field

Global Brand Leaders

Louis Vuitton: As part of LVMH, Louis Vuitton made about €22.2 billion in money from its Fashion & Leather Goods part in 2019. The brand keeps its place by means of great hand skill, classic plans, and smart world growth. Notably, its consistent strategy has maintained market dominance.

Hermès: This French high-end store reported money of €11.6 billion in 2022. Furthermore, in April 2023, Hermès set up three new leather work shops in France to boost making of its much wanted Kelly and Constance handbags. The Constance bag, priced at €6,500, stays in high want across Hermès's 300 world spots. Clearly, production expansion shows confidence in market demand.

This French high-end store reported money of €11.6 billion in 2022. Furthermore, in April 2023, Hermès set up three new leather work shops in France to boost making of its much wanted Kelly and Constance handbags. The Constance bag, priced at €6,500, stays in high want across Hermès's 300 world spots. For those interested in building a luxury handbag collection strategically, this comprehensive investment guide covers authentication, selection criteria, and portfolio strategies. Clearly, production expansion shows confidence in market demand.

Chanel: Known for its no-date plans and hand-made work, Chanel keeps its lead and makes very strong brand love in the luxury handbag field. Additionally, the brand maintains strict quality controls across all products.

Gucci: Under parent group Kering, Gucci has done well at mixing old hand work with new eco-safe moves and online growth. Accordingly, this balance has resulted in sustained market success.

Tapestry, Inc. (Coach): This group reported money sales of USD 6.68 billion in 2022, with Coach giving much to overall money. The brand has grown its all-channel features and online selling to hit more buyer groups. Furthermore, this expansion strategy continues to yield positive results.

Capri Holdings (Michael Kors): With full money of USD 5.65 billion in 2022, Michael Kors stays a big name in the easy luxury part. Undoubtedly, the brand appeals to budget-conscious consumers seeking style.

Prada: This Italian high-end house keeps strong market want all over the world by means of new plans and smart shop growth. Similarly, the brand maintains its premium positioning through exclusive designs.

Smart Ways for Market Lead

Top brands use many ways to keep their lead over rivals:

New Ideas and Working Together: Work with stars, set-amount goods, and work with now artists make one-of-a-kind goods and push buyer need. Essentially, limited collaborations create excitement and drive sales.

All-Channel Shops: Mixing body shops with online show places, online try shops, and easy online shops make sure brands meet buyers where they like to buy goods. Indeed, omnichannel strategy has become industry standard.

Made Just for You: AI-drive made-just-for-you work lets buyers make one of a kind handbags that fit their own style pick, making deep ties with brands. Importantly, personalization increases customer loyalty.

Real Checking Tech: Blockchain online cards and NFC micro chips fight against fakes while giving clear info about goods roots and fair work ways. Consequently, authentication technology builds consumer trust.

Product Types in the Handbag Market

Tote Bags

Tote bags are one of the most mixed and wide used kinds in the global handbag market. Known for their big rooms and work plans, totes appeal to work experts, learners, and shop goers. The global tote bag market was set at USD 2.68 billion in 2023 and is set to hit USD 3.6 billion by 2032, growing at a CAGR of 4.5%. Clearly, this segment continues to expand steadily.

Satchel Bags

Satchel bags have set up shapes and work-right looks, making them liked picks to brief cases. This part is expected to grow at a CAGR of 8.1% from 2023 to 2030, showing strong need for work-fit add-ons. Notably, this growth rate exceeds the overall market average.

Crossbody Bags

Crossbody bags have grown in use because of their help and hands-free plan. Mostly liked by young buyers and those with live-active ways, this part gains from style picks putting a focus on work use and less-is-more looks. Furthermore, practical design drives adoption among busy professionals.

Clutches

Clutches serve as smart adds for formal times and night times. Though caring for only a small market, this part stays strong by means of year-time goods and work with big names. Indeed, special occasion demand sustains this niche segment.

Luxury Backpacks

High-end backpacks mix style, work use, and high place worth. Made from top leather, suede, and top brand stuff, luxury backpacks appeal to city work experts, those who go a lot, and style-smart buyers. The part gains from new work ways, such as work from home, going a lot, and split work places. Importantly, changing work environments fuel this category's growth.

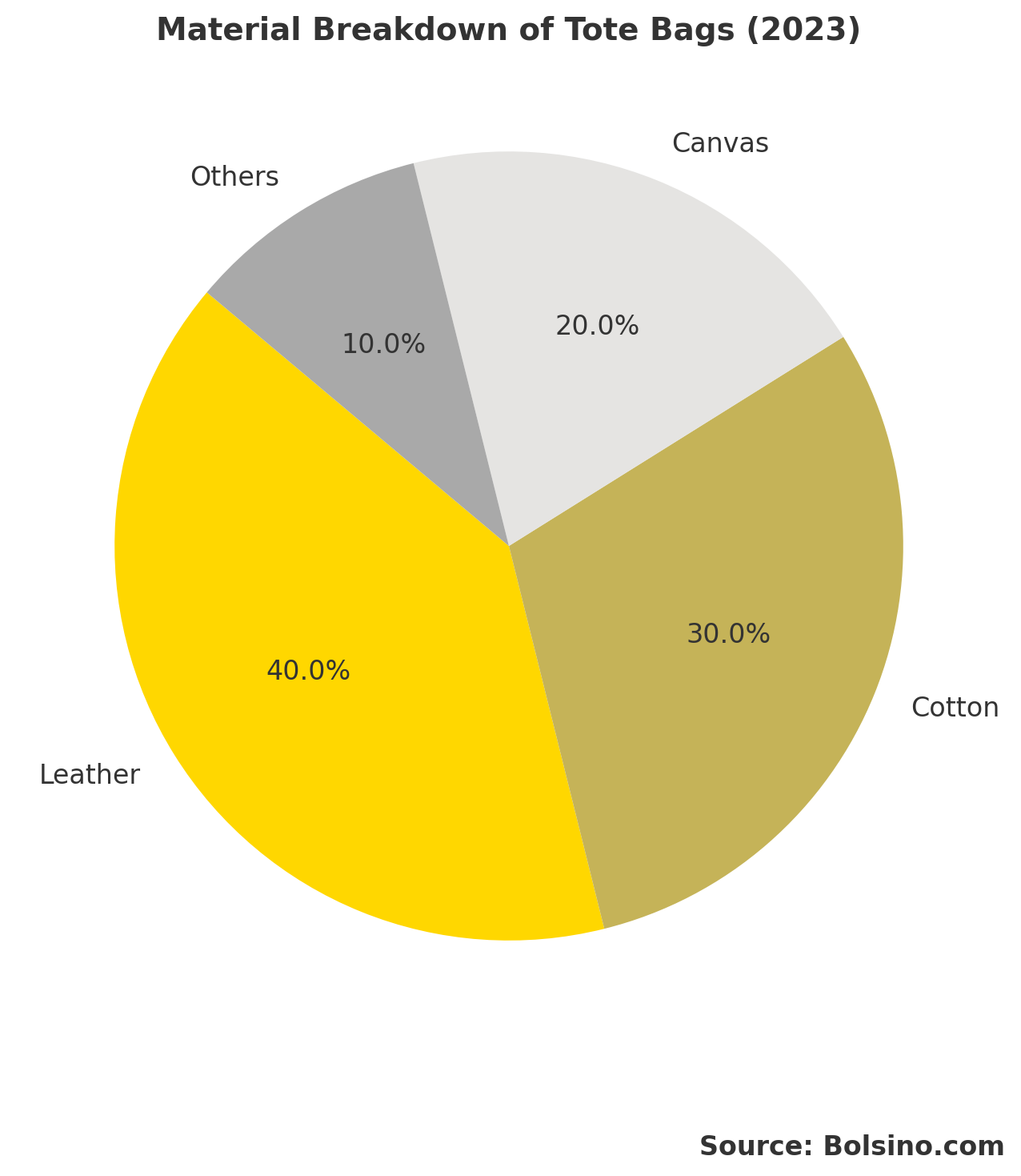

Stuff Split

Leather: Leather handbags lead the luxury handbag market due to their long life, no-date appeal, and top place. The leather part held a 40% market share in 2024. New ways of making safe leather, such as plant tanned leather and fair buying, appeal to world-care buyers. Significantly, sustainable production methods are gaining acceptance.

Made Goods: The made goods part is fast gaining as buyers ask for safe and no-cruelty goods. Luxury brands give new no-harm leather picks with fine plans and top looks. Goods take in pineapple leather, life-made mushroom leather, and Demetra (made by Gucci). Undoubtedly, innovation in materials is accelerating.

Cloth: Cotton, canvas, fake silk, and sheep's hair give light, mixed picks to leather. World-care cloth picks fit with safe styles while giving many plan picks. Moreover, fabric options continue to expand.

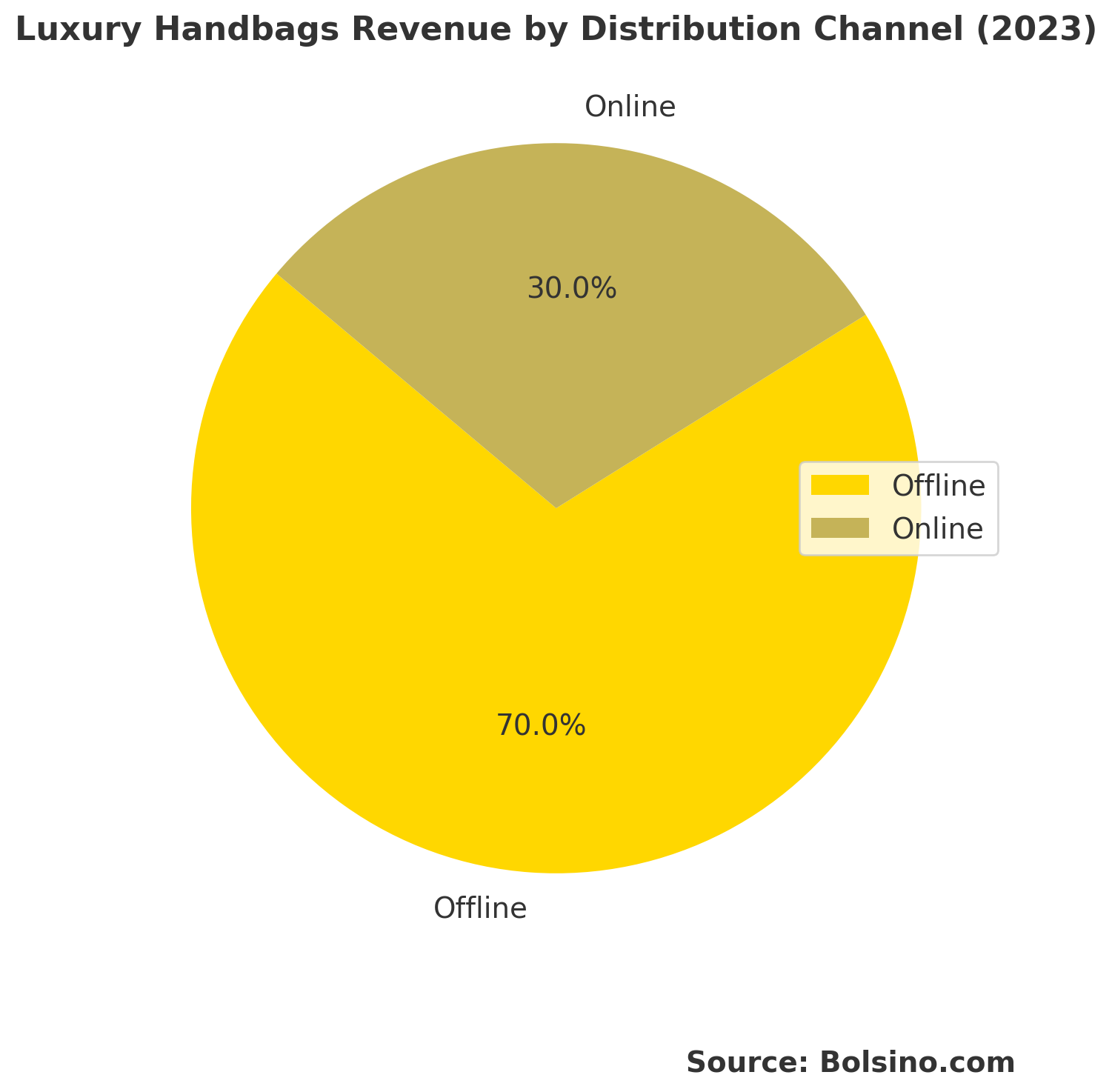

Ways to Sell Goods

Old-Time Shops

Old-time shop spots, such as group shops, top name stores, and brand main shops, made up 77.7% of the market in 2022. Old-time shopping gives hands-on feel, fast getting, and made-just-for-you buyer help that stay key for luxury buys. Evidently, physical retail remains important for premium products.

Big Shop Spots: Big shop groups and sale stores make handbags open to more buyer groups at many costs. These shops drive lots of sales, mostly in areas with big groups of people and many buyer types. Accordingly, mass retailers expand market accessibility.

Online Selling

Online selling has had big growth pushed by web reach, phone use, and new buyer ways. Online spots give huge product picks, fair costs, clear goods info, buyer words, and home getting help. Additionally, convenience drives e-commerce adoption.

Social Selling: Sites such as Instagram, TikTok, and Pinterest help direct sales by means of joined "get now" things, star ads, and live stream times. Social selling has mostly made online sales go up in Asia-Pacific spots. Notably, influencer partnerships boost visibility and conversion rates.

The online selling way is set to grow at a big CAGR in the future, showing a base move toward online shop spots. Consequently, retailers must strengthen digital capabilities.

What Comes Next and Market Forecasts

Growth Forecasts Through 2030-2035

The handbag market is set up for ongoing growth across all big areas and goods kinds. Market study shows the global market will grow from USD 59.62 billion in 2025 to USD 81.79 billion by 2030, showing a CAGR of 6.5%. For buyers looking to make smart purchases, identifying which designer bags offer the best investment potential can help maximize both style and financial returns. Furthermore, long-time forecasts say the market could hit over USD 143 billion by 2035, growing at a CAGR of 6.2%.

The luxury part specifically is set to hit USD 50.21 billion by 2035, growing at a CAGR of 6.2%. This growth will be pushed by more rich people in growth areas, mostly in Asia-Pacific and the Middle East. Essentially, wealth creation in emerging markets fuels premium demand.

New Trends Shaping What Comes Next

AI and Made Just for You: AI-drive made-just-for-you making will become a go-to move, letting buyers make picks by means of online tools. Guess-what-will-come-next info will help brands get better stock, guess new styles, and give made-just-for-you ideas based on past buys and style picks. Undoubtedly, artificial intelligence will reshape customer experiences.

Blockchain and Real Checking: Blockchain tech will give deep start info, fair work check, and real cards for luxury handbags. This hits fake good worry while making buyer trust go up. Consequently, security features become more sophisticated.

Online World and Online Shop: Web3 tech, online show spots, and online world shop times will make new ways to talk with buyers. Brands might give NFT-back online handbags with real goods. Notably, virtual shopping experiences are emerging.

Round Business: Used high-end shops keep going big, with groups just for used top handbags. Top brands are making their own re-sell plans, lease work, and get-back moves to make goods live long and cut waste. Importantly, circular economy models reduce environmental impact.

Smart Stuff: Tech work into handbags will grow past power work to add health track, safe work, and link ups with other smart goods. Additionally, wearable technology integration expands functionality.

Area Growth Chances

Asia-Pacific Lead: This area will keep the fast growth rate, pushed by India, South Asia, China, and Japan. More rich people in the middle, more women in jobs, and strong online shop way put Asia-Pacific as the most alive market. Clearly, this region will dominate global growth.

Europe Stay: Europe will keep using its old high-end brands, hand work ways, and trip business to keep market lead. New ways in safe high-end will hit with Europe buyers. Furthermore, heritage and tradition appeal to mature consumers.

North America Growth: Growth in North America will get help from money stay power, high buyer spending, and strong want for both luxury and open top parts. Accordingly, stable income supports continued purchasing power.

New Market Areas: The Middle East, Africa, and South America show big growth chance as money growth speeds up and luxury use goes up. Ultimately, economic development creates new opportunities for brands.

Wrap Up

The global handbag market shows good health and good growth promise through 2030 and past. Worth about USD 59.62 billion in 2025, the market is set to hit USD 81.79 billion by 2030, showing steady growth pushed by lots of good issues. Undoubtedly, the industry demonstrates strong fundamentals.

Key growth pushes take in more money to spend, growing online shop sites, new tech work, safe-made moves, and growing fashion interest all over the world. Europe and Asia-Pacific lead area markets, while top brands such as Louis Vuitton, Chanel, Hermès, Gucci, and Prada keep making market moves by means of new ideas and smart place work. Notably, brand innovation continues to drive market success.

The future of the luxury handbag field will be set by made-just-for-you feel, safe ways, online mix, and shop feel times. Brands that do well at mix old hand work with now tech, care for world with high-end pull, and global reach with local fit will take the biggest market ways. Importantly, adaptability will determine long-term success.

For those in the buy system—from makers and plan experts to shop owners and money people—knowing these market moves, buyer likes, and new trend is key for plan work and beat fight in this live, new field. Finally, staying informed about industry developments is critical for competitive advantage.

Commonly Asked Questions

What is the current global handbag market size in 2025?

The global handbag market is valued at about USD 59.62 billion in 2025, with forecasts to hit USD 81.79 billion by 2030. The luxury part specifically makes up USD 35.83 billion in 2025. Essentially, this represents significant market opportunity.

Which areas lead the luxury handbag market?

Europe holds the top market share at 36% in 2024, while Asia-Pacific marks the fastest-growing area with a CAGR of 7.7% from 2025 to 2030. As a result, both areas give big ways for market growth. Clearly, regional diversity strengthens overall market resilience.

What are the main growth pushes for the handbag field?

Big growth issues take in more money to spend, growing women in jobs, online shop growth, safe-made styles, new tech work, and growing fashion interest all over the world. Notably, multiple factors work together to fuel growth.

Who are the leading brands in the luxury handbag market?

Louis Vuitton, Hermès, Chanel, Gucci, Prada, Coach, Michael Kors, and Burberry mark the top players. These brands use great hand work, brand old ways, and smart new ideas to keep market lead. Importantly, brand heritage provides competitive advantage.

How is care for nature changing the handbag market?

Safe ways have become a key issue pushing buyer picks. Brands are taking up eco-safe stuff like no-harm leather, doing round system models, making sure clear buying, and putting no-carbon goals to fit buyer hopes. Consequently, sustainability has become essential to brand strategy.

What part does online selling play in handbag sales?

Online shop ways are going fast and are set to grow a lot through 2030. Online spots give help, huge goods picks, and made-just-for-you feel that draw now buyers, mostly in Asia-Pacific areas. Furthermore, digital channels continue gaining share.

What are the forecast growth rates for the handbag market?

The full handbag market is set to grow at a CAGR of 6.2-6.9% from 2025 to 2030. The luxury part will grow at about 5.98-6.2% CAGR in same times. Undoubtedly, sustained growth supports market confidence.

About the Author: This full market check wajs made by field experts who work with high-end goods market study and style field trends. The check takes in facts from top market study groups such as Grand View Research, Future Market Insights, Precedence Research, Persistence Market Research, and Spherical Insights & Consulting to make sure facts are right and can be trusted. Importantly, credible sources ensure content accuracy.

Market Data Sources: This piece references top market study files from Grand View Research (2024), Future Market Insights (2025), Precedence Research (2025), Persistence Market Research (2025), Spherical Insights & Consulting (2025), Fortune Business Insights (2024), and added field roots to give full, fact-led views into the global handbag market. Additionally, diverse sources provide comprehensive market coverage.

Ver artículo completo

What Factors Drive Luxury Bag Prices: A Complete Analysis

por Manuel Peters noviembre 01, 2025 9 lectura mínima

Thinking about investing in luxury handbags? Learn which brands, materials, and features drive the biggest price increases. Discover how rarity, condition, and demand affect resale value—plus simple steps to choose investment-worthy bags and keep them in top shape for maximum return.

The Complete Guide to Luxury Handbag Investing in 2026

por Manuel Peters noviembre 01, 2025 31 lectura mínima

Hermès Birkin vs Kelly Comparison: The Best Choice in 2026

por Manuel Peters junio 30, 2025 16 lectura mínima